Investable Art: Factors Influencing an Artist’s Valuation.

When it comes to investable Art, various factors contribute to an artist’s valuation and the perceived value of their works. While some elements are widely acknowledged, others, such as the concept of limited supply and luck, have been subject to debate within the art world. In this blog post, we will delve into the factors that truly influence an artist’s valuation, examining the role of limited supply and its relationship to an artist’s success.

- Artistic Reputation and Recognition: An artist’s reputation plays a crucial role in determining their valuation. Recognition by prestigious art institutions, participation in renowned exhibitions, and critical acclaim establish an artist’s credibility and elevate the perceived value of their works. This recognition is based on the quality and impact of an artist’s creations, rather than artificial scarcity.

- Market Demand and Collector Preferences: The demand for an artist’s works directly affects their valuation. Market trends, collector preferences, and shifts in artistic movements influence the demand for specific artists. While some artists might deliberately limit the number of works they produce, it is the market’s response to their art that determines its value.

- Artistic Innovation and Influence: Artists who introduce new techniques, styles, or concepts often attract attention and contribute to the evolution of art. Their influence on subsequent generations and their impact on the art world can enhance an artist’s valuation. The significance of an artist’s contribution to art history is not based on scarcity, but rather on the transformative nature of their work.

- Track Record and Consistency: An artist’s track record of producing high-quality works consistently over time can positively influence their valuation. Consistent artistic growth, successful sales, and a stable market presence indicate a strong investment potential. However, this is not directly related to limited supply but rather to the artist’s dedication and ability to consistently create compelling art.

- Rarity and Historical Significance: While limited supply might not be the primary driver of an artist’s valuation, the rarity and historical significance of certain works can contribute to their value. Historical masterpieces or works that mark significant milestones in an artist’s career or artistic movement can command high prices due to their cultural and historical importance.

- Persistence and Hard Work: The art world is highly competitive, and success often requires perseverance and hard work. Artists who consistently dedicate themselves to honing their craft, developing their style, and actively seeking opportunities for exposure increase their chances of success. The willingness to navigate challenges and overcome obstacles is an important factor in achieving recognition. As a collector, you should be paying attention to the hard working artist, because ultimately they are working to ensure the value of their works rise in the market. As their work continues to grow, they test the limits of their abilities within the work itself and in turn the art market.

- The Collector’s Eye: beyond monetary factors, you should buy what draws your eye. Whether the painting pierces your heart or makes you frown, be adventurous and buy something that moves you, that makes you question your existence on this planet. There are thousands of traditional landscape paintings out there; why not hang something eccentric, quirky, distinctive, and extraordinary on your walls?

Investable Art: Factors and the Role of Luck in an Artist’s Success

While the art market does use the concept of limited supply to create an aura of exclusivity, it is not the defining factor in an artist’s valuation or their success. Artistic reputation, market demand, collector preferences, artistic innovation, and historical significance have a more significant influence on an artist’s valuation. Understanding these factors can help investors make informed decisions based on the true merits of an artist and their works, rather than relying solely on the notion of limited supply.

Investing in artists and their works requires a balanced understanding of the key factors that contribute to their success. While talent, persistence, networking, timing, and effective marketing strategies are essential, luck also plays a role in an artist’s journey. Recognizing the combination of these elements can help investors make informed decisions while acknowledging the inherent unpredictability of the art market. Ultimately, investing in art entails both strategic evaluation and an appreciation for the intangible factors that contribute to an artist’s level of success. Most importantly, buy something that moves you!

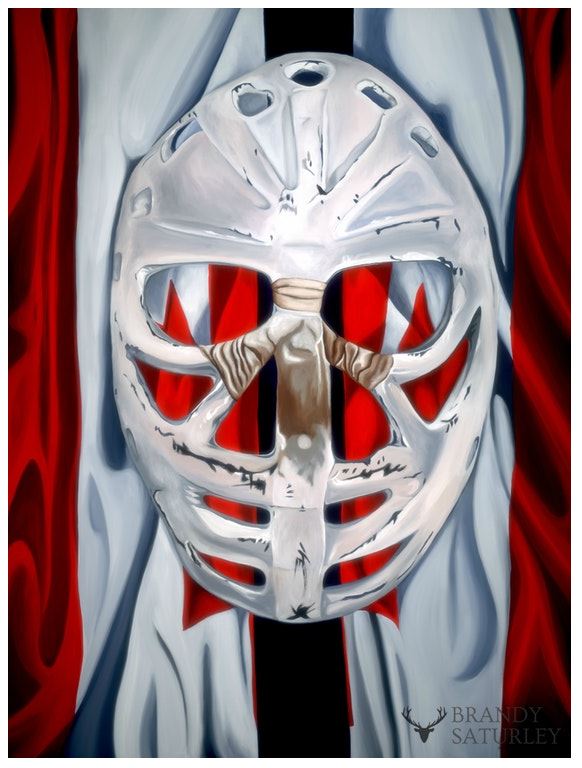

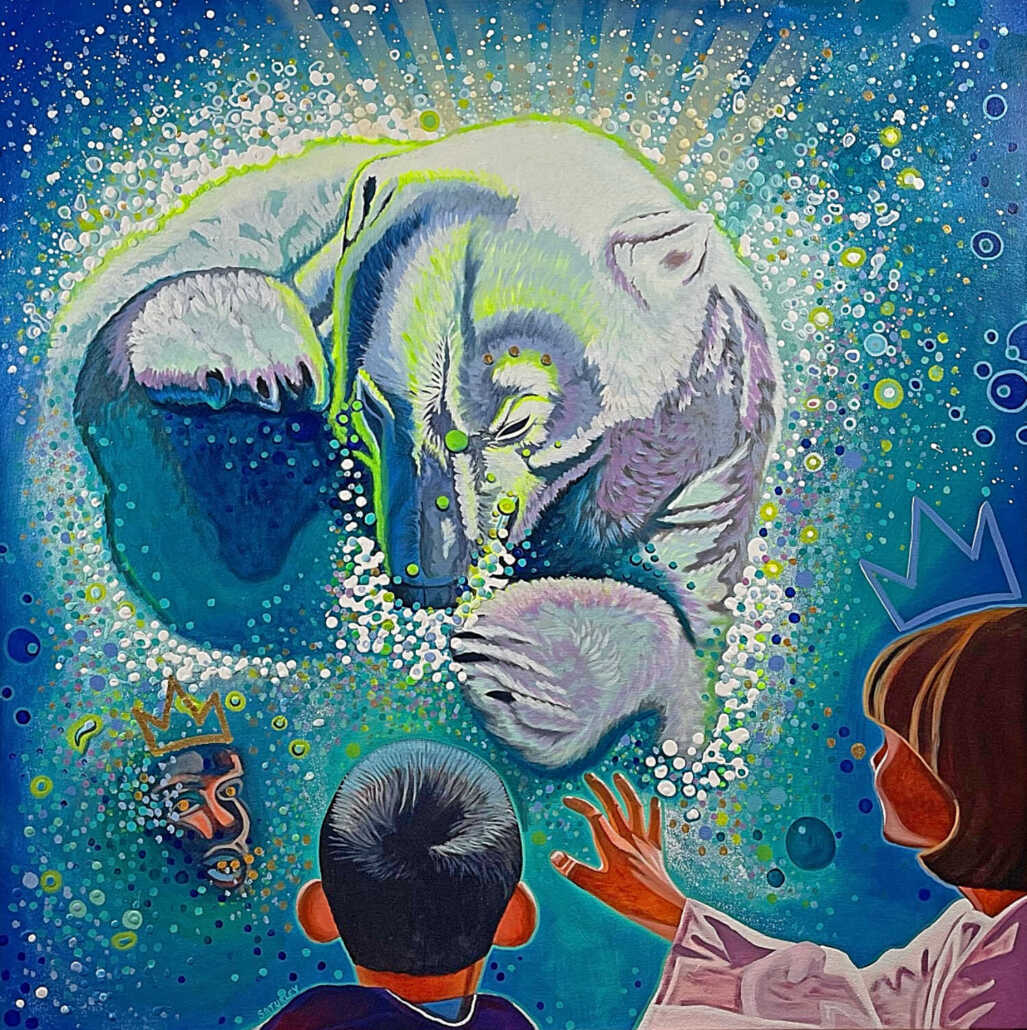

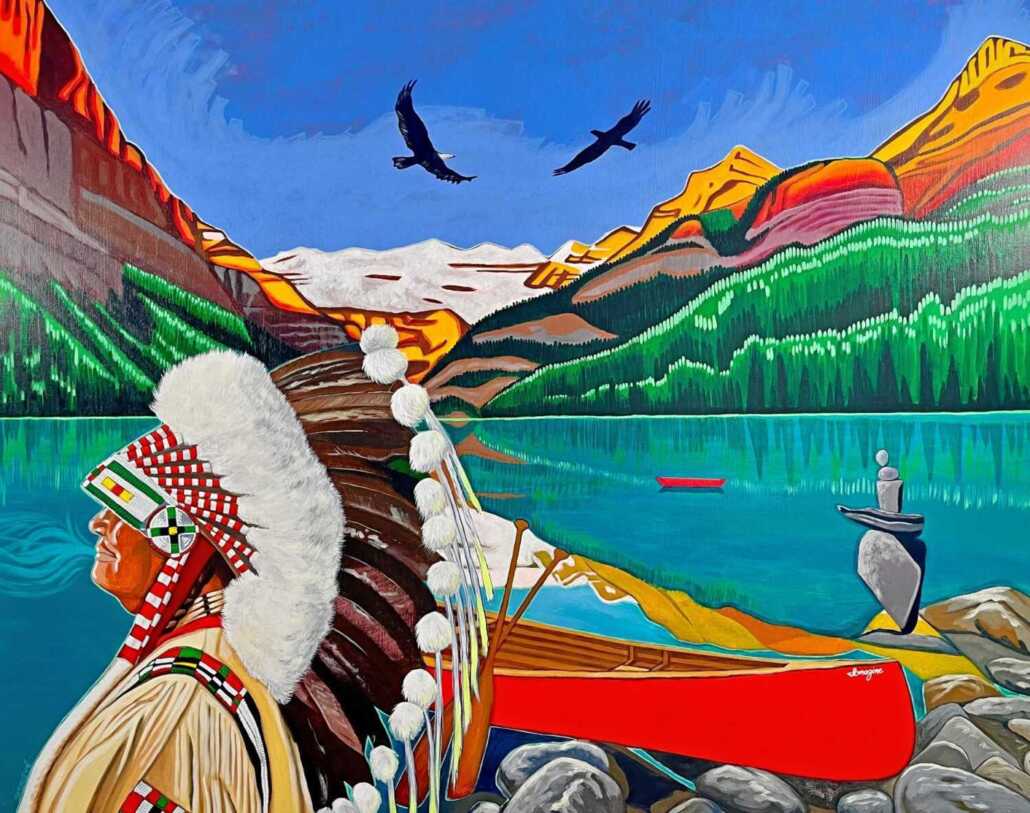

10 Paintings to Invest in now, by Canadian Artist Brandy Saturley

Brandy Saturley, a Canadian artist, embodies the qualities that make her art a compelling investment opportunity. Her unique artistic vision, recognized by prestigious institutions and critics, showcases a consistent track record of high-quality works. With a strong market demand and a growing following, Saturley’s art aligns with current trends while pushing boundaries. Her innovative approach and cultural impact contribute to her legacy as an influential artist. By acquiring Saturley’s art now, collectors can secure not only aesthetically captivating pieces but also a potential long-term investment that reflects the artist’s rising reputation and the increasing demand for her work. Here are 10 imaginative, quirky, vivid and extraordinary paintings by Brandy Saturley to invest in now.

10. The Conversation – current price May 2023, $9000.00 CAD

9. King of The Polar Bears – current price May 2023, $7500.00 CAD

8. Golden Hour in The Heart of Canoeland – current price May 2023, $8900.00 CAD

7. Imagine Canoe – current price May 2023, $12,000.00 CAD

6. Dreaming in the Colours of Eh – current price May 2023, $7500.00 CAD

5. Balance– current price May 2023, $7500.00 CAD

4. Habitant– current price May 2023, $9000.00 CAD

3. Canadiens Gothic – current price May 2023, $15,575.00 CAD

2. Saint Kanata– current price May 2023, $15,575.00 CAD

1. Goalie’s Mask: red, white & Dryden – current price May 2023, $91,000.00 CAD