Tax Benefits Canadian Art

Maximize Your Tax Benefits: Invest in Original Canadian Art for Your Business

Have you ever considered leveraging your tax refund to enrich your corporate environment? Instead of opting for conventional investments, why not explore the lasting benefits of acquiring original Canadian art from independent living artists? Original art not only fosters discussion and entertainment but also enhances the aesthetic appeal of your corporate spaces, ultimately adding value to your business premises. Following are some Tax Benefits of purchasing original Canadian Art.

Golden Hour in The Heart of Canoeland, Acrylic 36 x 60 x 1.5 in (91.44 x 152.4 x 3.81 cm) Brandy Saturley

Embrace the Opportunity to Define Your Brand:

Decorating your corporate offices with original Canadian paintings serves as more than mere decoration. It’s an opportunity to convey your brand’s ethos and warmth to clients and employees alike. Each piece of art injects a sense of taste, class, and sophistication, elevating your corporation’s image and fostering a sense of community within your workspace.

Tax Deductions Make Art Acquisition a Smart Investment:

Did you know that purchasing original Canadian art offers substantial tax benefits for your business? The Canadian government actively supports investments in Canadian artwork by offering tax incentives to businesses of all sizes. By investing in the Canadian art market, not only do you enrich your corporate environment, but you also enjoy tax deductions under the Capital Cost Allowance scheme. Consult your accountant for personalized advice on maximizing these benefits.

Make Art Acquisition Affordable with Fine Art Financing:

Art Lease Canada provides an attractive solution for businesses looking to invest in fine art without significant upfront costs. With low-interest financing and flexible payment terms, building an impressive art collection becomes accessible to businesses of all sizes. Plus, by financing your Canadian art purchases, you can claim these expenses as tax-deductible business expenses, further enhancing your financial benefits.

Tax Benefits – Buy Original Canadian Art Because You Love It:

Beyond financial considerations, the primary motivation for investing in original Canadian art should always be personal connection and appreciation. Each artwork is a testament to the artist’s creativity and vision, resonating with your own sensibilities. By nurturing a direct relationship with the artist, you not only acquire a unique piece of art but also contribute to preserving Canada’s artistic heritage for future generations.

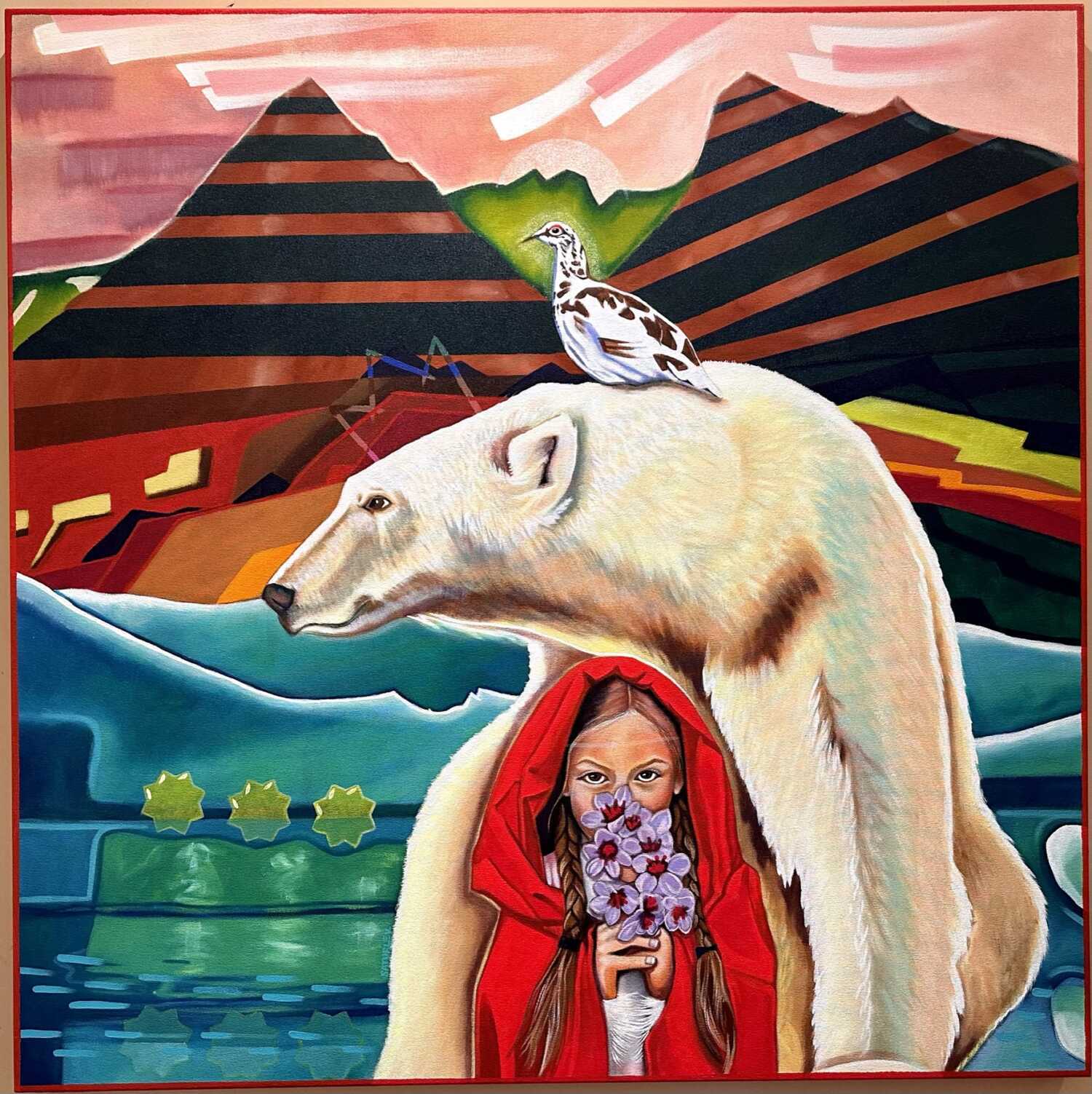

Monarch of The Arctic Realms – Acrylic – 48 x 48 x 1.5 in (121.92 x 121.92 x 3.81 cm) Brandy Saturley

Unlock the Benefits of Investing in Original Canadian Art:

Whether it’s paintings, sculptures, or photographs, investing in original Canadian art offers both aesthetic and financial rewards. Take advantage of the tax deductions available for business art purchases and explore financing options to make art acquisition more accessible. By infusing your corporate spaces with original Canadian art, you not only enhance your brand’s image but also contribute to the vibrant cultural landscape of Canada.

Discover a beautiful painting for your lobby or office, now.

Commission a custom painting for your business with Brandy Saturley